Is Microsoft's Nokia Strategy Working?

Now that Microsoft is buying Nokia's phone business, the Finnish company's financial results are less important to the Microsoft ecosystem. Nokia was Microsoft's most strategic partner in CEO Steve Ballmer's long game to become a player in smartphones. One major reason to pay attention to Nokia's financials was to determine if the company would survive its former CEO Stephen Elop's plan to transition to the Windows Phone platform.

The other major reason to pay attention was to see how many Lumias, the flagship brand for Windows Phone, Nokia had sold in the preceding three months. With Nokia Lumia devices accounting for 80 percent or more of Windows Phone shipments in recent quarters, Lumia sales were a good indicator of the Windows Phone platform's overall health.

Until Microsoft integrates the Nokia devices business into its own company sometime in the first calendar quarter of 2014, the Nokia financial results will continue to be the key place to find out how Windows Phone is doing. In fact, given Microsoft's usual practices, that integration could be the end of regular reporting of Lumia unit sales. For example, Microsoft declined to tell the market last week how many Surface units were sold in its most recently completed quarter. We'll probably have to rely on IDC or Gartner estimates of Windows Phone unit sales rather than quarterly company reports from Microsoft.

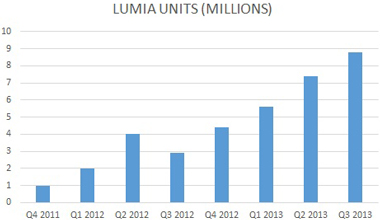

Let's take a look at the data, though, while we still have it. Nokia's financial results on Tuesday were very promising for Microsoft's phone platform. Nokia reported that it had sold 8.8 million Lumia units in the July-September period. That's nearly a 19 percent improvement sequentially over the previous quarter and about triple the number of devices Nokia sold in the year-ago quarter.

Figure 1.

Figure 1.

A look at Nokia's Lumia sales since the company first started shipping the Windows Phone-based devices in the fourth quarter of 2011 shows a nearly steady march upward in units, with the exception of a dip in the third quarter of 2012 (Figure 1). It's a pretty chart, the kind executives like to show to investors.

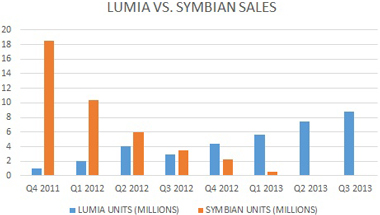

Another chart illustrates why Nokia was eager to jettison the devices business. Elop, the former Microsoft executive who is returning to Microsoft with the sale of Nokia assets, originally projected that Nokia would sell 150 million additional Symbian smartphones as it managed the transition of its customers to Windows Phone and Lumia. Symbian had been the powerhouse of the smartphone industry in the pre-iPhone era. The 150 million Symbian projection proved hopelessly optimistic. In reality, Nokia managed to sell about 41 million more Symbian devices in the Lumia era, which stretched from the fourth quarter of 2011 until the company effectively stopped offering Symbian devices in the first quarter of 2013 (Figure 2).

Figure 2.

Figure 2.

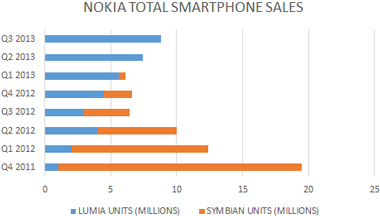

Another chart illustrates what a gigantic hole that rapid dropoff in Symbian sales left in Nokia's business. At a time when the overall smartphone market was vaulting to ever higher shipment totals quarter after quarter, Nokia was watching its absolute number of smartphone unit shipments drop. See the third quarter of 2012 and the first quarter of 2013 for the worst parts (Figure 3).

Figure 3.

Figure 3.

But the blue part -- Microsoft -- of the blue and orange bars kept accounting for more and more of the sales quarter-by-quarter, and that is the only part of the business that has ever mattered to Redmond.

Where it gets interesting is that with this quarter's results, Nokia's Lumia sales are starting to become a significant number in the market. Sure, the IDC smartphone estimates also released on Tuesday show a market dominated by Samsung at 81 million units, followed by Apple at a distant second with 33 million units.

The next tier, though, is Huawei, Lenovo and LG. All three are in the 12 million unit range. Nokia is coming up on that group fast. Another quarter of 20 percent growth would put Lumia at about 10.5 million units -- and fourth quarters are traditionally strong so Windows Phone's performance could conceivably be even better than that.

None of this is to say that the ball of Windows Phone progress couldn't get fumbled in the Nokia-to-Microsoft handoff. The trajectory, though, suggests that Microsoft will just keep on coming and has a credible chance of becoming not just the third-place smartphone platform but the third-place global smartphone maker, as well, in the next few quarters.

Related:

Posted by Scott Bekker on October 30, 2013